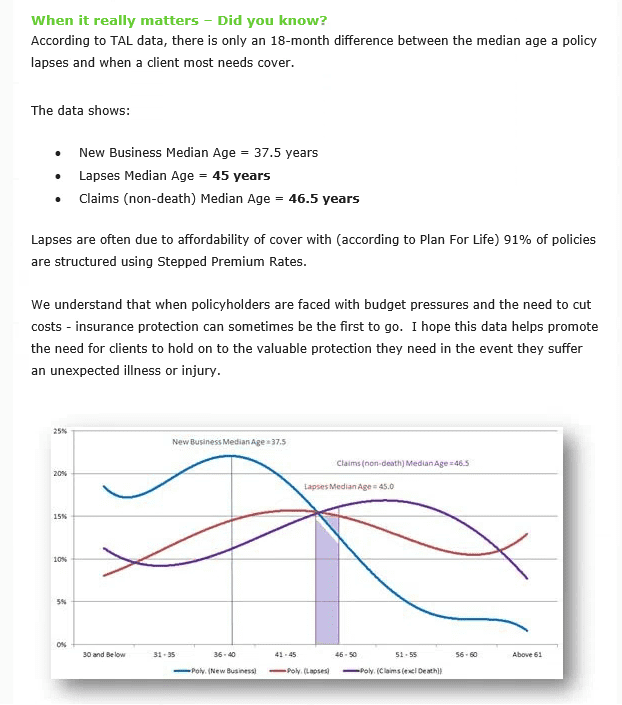

An issue we frequently come across with our clients who are in their 50’s and beyond is the cost of their life insurance and associated covers (ie, income protection, trauma and TPD) substantially increasing each year (at least 10 to 15% per annum). Most people’s default strategy is simply cancelling their policies when the insurance premiums become unaffordable. The statistics on this are: the median age of a claim is 47 years while the average age of cancellation of policies is 45 years old.

We often find when we review clients existing insurance they aren’t aware of what they have in place, how much it’s costing them and what

happens in the event of an insurance event (such as death, illness or accident). Another issue we see, when reviewing is their ‘insurance

budget’, or the amount they are willing to spend monthly for the insurance is not properly utilised, for example holding a large Life

premium but no actual cover for sickness or disability.

At Easdowns Financial Services, we will work closely with you to help you understand your insurance cost, what you have in place, and what you need to reach your goal of retirement. We review your cover to ensure it is the most cost-effective and best quality cover that the market has to offer. But what’s most important is that you have control of the insurance cost and understand what your wealth protection plan entails.

If you would like to review your insurance needs with a specialist wealth protection adviser at Easdowns Financial Services, please don’t hesitate to give us a call on (02) 6921 2058, or alternatively email us at financialservices@easdowns.com.au. We can then organise a free meeting with one of our professional advisers.

Don't miss out on the latest Finance and Accounting Updates Sign up for our Newsletter and stay in the loop.